You can find your credit limit in your online American Express account.

- Once you log in to your account, choose the card you want by clicking on the credit card icon in the upper right corner of your screen. …

- Then you will be able to see your available credit limit in the Home section of your credit card account.

Furthermore, How do I check available credit? Here are three ways you can easily check the available credit on your credit card before making a purchase that could put you over your credit limit.

- Your Mobile/Online Account.

- Your Billing Statement.

- Customer Service Line.

- Raising Your Available Credit.

- Credit Cards With No Preset Spending Limit.

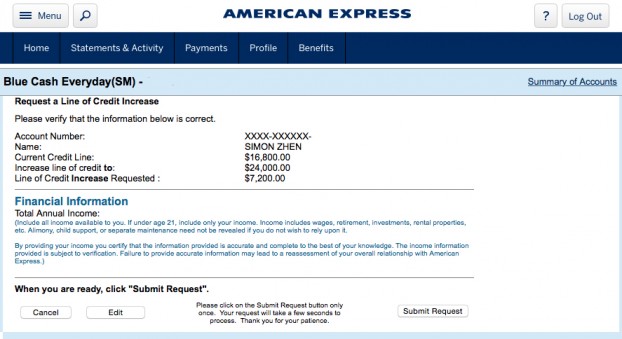

Does American Express increase credit limit automatically? Does American Express automatically increase credit limits? American Express may automatically increase your credit limit as often as every six to 12 months. However, just because you haven’t received an automatic increase doesn’t mean you’re not eligible. You should reach out to American Express to see if you qualify.

Besides, What is the minimum credit score for American Express? The American Express credit score requirement is 700 or above, depending on the card. That means people with good to excellent credit are eligible to be approved for an American Express credit card.

Contenus

Can you buy a car with a credit card?

A dealer might let you use a credit card for a portion of the cost, but don’t expect to pay for the whole thing with plastic. Even if you can use a credit card, expect to pay a fee that raises your costs and offsets the value of any rewards. Interest on auto loans is much lower than on credit cards.

also, How can I view my credit card statement online? You can view your credit card statement online at any time by logging into your online credit card account and navigating to the statement information. If you’ve opted into electronic statements, your card issuer should send you an email every month when your new statement is available.

How long after payment is credit available? It can take one to three business days for an online or phone payment to post to your credit card account and reflect in your available credit. 1 That’s because payments made using a checking account and routing number are processed in batches overnight and not in real time.

What is my credit limit? Your credit limit is the total amount of charges you’re authorized to make on a credit card. When you apply for a credit card, the lender will examine elements of your financial history and determine your credit limit, or the maximum amount you’re allowed to borrow.

Does American Express verify income?

No, American Express does not verify income on most credit card applications or credit line increase requests. Amex will generally require income verification only if something seems out of the ordinary, such as a 21-year-old claiming to have an annual income of $150,000.

Does Amex count towards credit score? In many ways, this means that charge cards share one of the best benefits of business credit cards, namely that purchases you make don’t directly affect your personal credit report. Note that Amex will still report your statement balances to the credit bureaus, even if they don’t affect your credit score.

What is Amex gold card limit?

Does the American Express Gold Card have a limit? The American Express® Gold Card has no preset spending limit, which reflects its origins as a charge card — a card that requires you to pay your bill in full every month. Nowadays, the card allows you to pay for some purchases over time.

Can I get an Amex card with a 650 credit score? Although this card carries no annual fee, folks report needing a credit score of at least 680 to get approved. But some others were approved with scores of as low as 650, so you might have a good shot even with less of a credit history.

Can I get an American Express card with a 600 credit score?

Cards such as the Amex EveryDay® Preferred Credit Card from American Express and Blue Cash Preferred® Card from American Express usually recommend a 670+ score. However, there is anecdotal evidence of scores in the lower 600s being approved.

Is it hard to get an American Express Gold card?

Yes, it is hard to get the American Express® Gold Card because it requires at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be very hard for you to get approved for the Amex Gold card.

Do millionaires use credit cards? Millionaires use credit cards like the Centurion® Card from American Express, the J.P. Morgan Reserve Credit Card, and The Platinum Card® from American Express. These high-end credit cards are available only to people who receive an invitation to apply, which millionaires have the best chance of getting.

What is the limit of a black card? No spending limit: Because the Centurion® Card has no preset spending limits, you can use it to buy big ticket items that you may not be able to purchase with other credit cards. Since a black card is a charge card rather than a credit card, charges must be paid in full each month.

More from Foodly tips!

Who qualifies for a black card?

Generally, a card issuer invites only their most loyal customers who spend upwards of six-figures or more a year to become a black cardholder.

How do I check my balance on my credit card over the phone? To check your credit card balance over the phone, call the customer service number on the back of your credit card. You’ll likely be asked to enter your card number and/or other personal information to verify your identity.

How can I get my billing statement?

Your credit card statement will typically come in the mail, but if you’ve opted for online, or paperless billing statements), you’ll either receive an email statement or you’ll need to log on to your credit card issuer’s website to check your statement.

How do I get my card statement? To get their credit card statement online, cardholders will need to log into their netbanking account. Once they log in, they will be able to see basic information about their credit card including available credit, minimum amount due, unbilled amount, next due date, most recent balance, among others.

Help Foodly.tn team, don’t forget to share this post !