View my billing statement online

- Select My Account.

- Select Macy’s Credit Card.

- Select the Statements & Recent Activity button.

- In the Download Statements section, choose the date and format of the statement you want to view or print, then select the Download button.

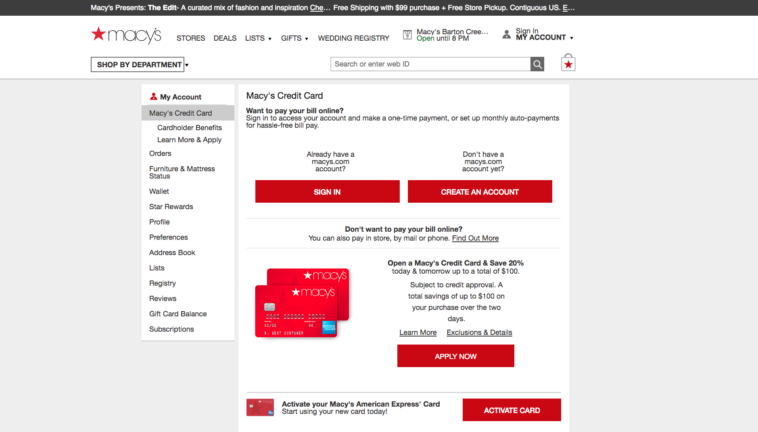

Furthermore, How do I pay my Macy’s bill online? Go to Macy’s online account page and sign in with your email address and password. Select « Make a Payment. » Follow the prompts to select the amount you want to pay, the date you want to pay and the authorized account you are paying from. Note that you cannot use a debit card for making a payment.

Why can’t I log into my Macy’s account? If you have too many failed sign-in attempts to your online profile and it is locked, please directly call us at 1-800-BUY-MACYS (1-800-289-6229).

Besides, What is my Macy’s credit card account number? Note: You can usually find this number on the bottom of a check or on your account statement. You must type this number correctly for your payments to be processed. In Account Name, type something that identifies the account to you, such as Personal Checking or Business Checking.

Contenus

What bank is Macy’s credit card through?

The Macy’s Credit Card is issued by Department Stores National Bank, a subsidiary of Citibank. Since Macy’s is a department store, it doesn’t have a banking license.

also, What is the 800 number for Macy’s credit card? Call us toll-free at 1-866-470-8613 for further information.

Is Macy’s credit card by Citibank? The Macy’s Credit Card is powered by Citibank, and you can now apply for the card online. If you’re looking for a Macy’s rewards card that can be used anywhere, consider getting the Macy’s American Express Card.

Is Macy’s credit card a hard inquiry? Yes, the Macy’s Store Card will do a hard pull. You will need a credit score of 640+ to get it. This means that the Macy’s Store Card requires fair credit, which is on par with what most store cards require.

Is a Macy’s card a credit card?

The Macy’s Credit Card is a store card, which means you can only use it at Macy’s properties. If you prefer a full-use credit card to use on spending outside of Macy’s, there is a Macy’s American Express Card, which offers 1% to 3% back on purchases at gas stations, supermarkets, restaurants and more.

How do I speak to Macy’s customer service? If you have any questions, contact Customer Service at 1-800-BUY-MACY (1-800-289-6229).

How do I contact Macy’s?

You go on their employee portal and click the call out button. you will loose points. When you « call out » your shift means that you are not coming into work for a reason and you lose points when you do not show up.

Can I use Macy’s credit card anywhere? The Macy’s Store Card can’t be used anywhere. It can only be used at Macy’s and macys.com. The Macy’s American Express Card, on the other hand, can be used anywhere Amex is accepted, including Macy’s.

What Bureau does Macys pull?

Macy’s Credit Card reports the card’s credit limit, account balance, payment history, and more to all three of the major credit bureaus: TransUnion, Equifax, and Experian. Department Stores National Bank may use a specific credit bureau more than another, depending on the applicant’s home state, and other factors.

Where does Macy’s pull credit?

What Credit Bureau Does Macy’S Use? Macy’s pulls credit scores from one of the big three bureaus (Experian, TransUnion, Equifax). Applying for a credit card means a hard pull, which impacts your credit. If you have multiple unauthorized pulls on your credit, you can dispute them (fast) with Credit Glory’s help.

What credit score do I need to get approved for a Macy’s card? You need good or excellent credit (700 or higher) to get the Macy’s Amex, and at least fair credit (640 or higher) to get the Macy’s Store Card.

What is the highest credit limit for Macy’s credit card? Most cardholders report Macy’s card credit limits ranging from $500 to $2,500. In general, credit card limits vary, based on three main factors: your credit score, your income and your current credit utilization ratio.

More from Foodly tips!

What is the highest Macy’s credit card?

Macy’s Card Rewards and Benefits

Platinum: This is the highest tier possible and is only available for customers who spend ‘$1,200 or more each year at Macy’s stores. These customers receive all the perks offered in the silver and gold tiers, and they also earn 5% back in rewards on every purchase.

Does Macy’s refund stolen packages? Macy’s will process your refund if your package got stolen. You can apply for a refund within 45 days of the expected delivery date. To process this, you have to contact Macy’s customer service and inform them about the stolen or missing item immediately after you notice you have not gotten your order.

What is Macy’s CEO salary?

Compensation by Company

| Name And Title | Total Compensation |

|---|---|

| Jeff Gennette Chief Executive Officer | Total Compensation $10,776,744 View details |

| Danielle L. Kirgan Chief Transformation Officer | Total Compensation $5,411,869 View details |

| Paula A. Price Former Chief Financial Officer | Total Compensation $802,505 View details |

What is Macys HR phone number? status, benefits eligibility (if applicable), and any other requirements. If you have any questions about your benefits eligibility, call 1-800-234-MACY (6229).

What time does Macy’s pay?

24 answers

Employees are paid once a week on Fridays. Regular part time in fullfillment center for online orders and it’s 10.50 hr paid every Friday. The employees are paid biweekly and also made commission.

Does Macy’s card affect the credit score? A retail card doesn’t just affect your scores by spiking your credit usage. When you apply for new credit, you typically get hit with a hard inquiry when the issuer pulls one of your credit reports.

What is a THD Cbna account?

THD/CBNA stands for The Home Depot/Citibank North America. It could be on your credit reports as a hard inquiry if you’ve applied for a credit card from The Home Depot or if you’ve been added as an authorized user on one of these accounts.

What is the easiest credit card to get approved for? Summary: WalletHub’s Picks for Easy Credit Cards

| Credit Card | Best For | Editor’s Rating |

|---|---|---|

| Credit One Bank® Platinum Visa® for Rebuilding Credit | Unsecured | 3/5 |

| Capital One Platinum Credit Card | No Credit | 5/5 |

| Wells Fargo Business Secured Credit Card | Business | 3/5 |

| Capital One Quicksilver Secured Cash Rewards Credit Card | After Bankruptcy | 5/5 |

• 1 mars 2022

Help Foodly.tn team, don’t forget to share this post !