Businessman Hui Ka Yan founded Evergrande, formerly known as the Hengda Group, in 1996 in Guangzhou, southern China. Evergrande Real Estate currently owns more than 1,300 projects in more than 280 cities across China.

Furthermore, Will Evergrande affect crypto? For now, there’s no direct link between Evergrande and the crypto universe. It appears to be a case of widespread risk aversion, with investors going to cash.

Is Evergrande going to collapse? But perhaps the most immediate impact of an escalating crisis in the Chinese property sector would occur in the world of financial markets. Evergrande’s collapse will be felt in the world’s financial markets.

Besides, Can Evergrande cause financial crisis? China Evergrande Group’s troubles are unlikely to trigger a financial crisis given the low exposure of local banks to the debt-laden developer and the ability of Chinese regulators to control markets, the Bank of Korea said Sunday.

Contenus

Is Evergrande going to default?

BEIJING — Indebted property developer China Evergrande defaulted this week with hardly a ripple in markets as most institutions remained silent. Late Thursday, Fitch Ratings said Evergrande had not confirmed payment of its latest debt obligation, triggering a default.

also, Will Evergrande cause a market crash? Analysts see China’s real estate market entering a period of stress but Beijing moving to contain fallout.

Does tether hold Evergrande? Tether has denied holding any Evergrande debt, but its lawyer declines to say whether Tether had other Chinese commercial paper. He says the vast majority of its commercial paper has high grades from credit rating firms. Tether has made billions of dollars of crypto-backed loans.

Why crypto is crashing now? Here are six reasons why cryptocurrencies crash. Next:Crypto investors taking on too much leverage. Crypto investors taking on too much leverage. Crypto data firm CryptoQuant’s BTC leverage ratio hit all-time highs in early January, meaning more investors are taking on risk in the crypto space.

Do Evergrande own property in Australia?

According to the Reserve Bank of Australia (RBA), “Evergrande has: sold properties at steep discounts; sold other assets; delayed payments to suppliers, holders of its wealth management products and on some of its other liabilities; and sought to offer debt holders discounts on properties in lieu of payments.”

Who are Evergrande lenders? Evergrande is one of China’s leading lenders for everything from property to autos. The company has 2.3 trillion Chinese yuan in assets, which equates to about $355 billion in USD, according to the lender, which employs 200,000 workers.

What is China Evergrande and why is it in trouble?

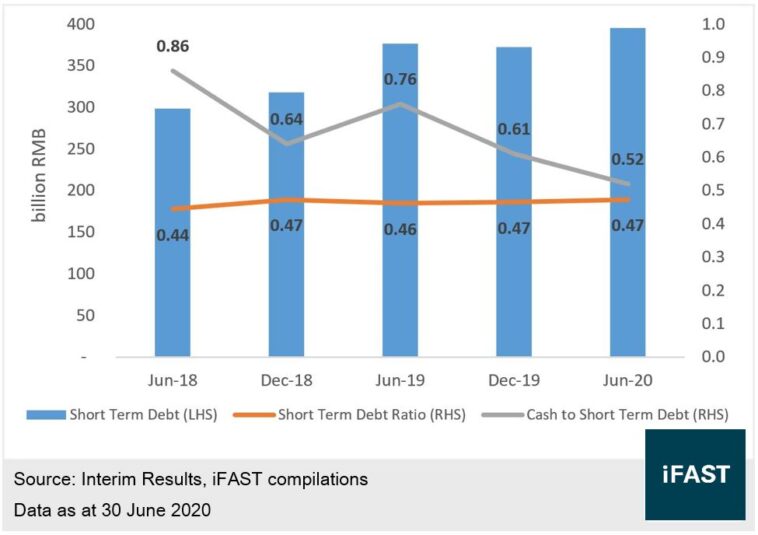

The world’s most-indebted developer had a liquidity scare in 2020. Evergrande reportedly sent a letter to the provincial government of Guangdong in August, warning officials that payments due in January 2021 could cause a liquidity crisis and potentially lead to cross defaults in the broader financial sector.

Will Evergrande affect US economy? Peter Cohan, a lecturer at Babson College and author of “Goliath Strikes Back,” told GOBankingRates that Evergrande’s default will have no significant effect on the U.S. economy since it has only $20 billion in U.S. dollar bonds outstanding.

Will Evergrande affect US?

The issues surrounding Evergrande are among several financial risks the Fed said had the potential to hit the US. Other risks include a potential worsening of the public health situation and a sharp rise in interest rates.

Who invested in Evergrande?

Rival Hong Kong-listed property company Hopson Development is set to buy a 51% stake in Evergrande Real Estate for around $5bn, according to Chinese media reports.

Is Tether a Chinese company? Tether (often called by its symbol USDT) is a cryptocurrency that is hosted on the Ethereum and Bitcoin blockchains, among others. Its tokens are issued by the Hong Kong company Tether Limited, which in turn is controlled by the owners of Bitfinex.

Is Tether a risk to Bitcoin? It’s also used for leveraged cryptocurrency trading, Li points out. That means if Tether loses its peg, it can also tank Bitcoin and Ethereum. (Tether is involved in more Bitcoin transactions than the US dollar is.) “It can be construed as part of a systemic risk,” Li says.

More from Foodly tips!

Is Tether a super stable crypto?

Tether is what’s come to be known in financial circles as a stablecoin—stable because one Tether is supposed to be backed by one dollar. But it’s actually more like a bank.

Will Bitcoin go back up 2022? Predictions For 2022

Bitcoin started 2022 at $46,657.53. Given that important trading factors remain steady, the price prediction indicates that many expect Bitcoin to reach $50,000 by the end of the year.

Which cryptocurrency should I invest in 2021?

- Bitcoin (BTC) Market cap: $880 billion. …

- Ethereum (ETH) Market cap: $415 billion. …

- Tether (USDT) Market cap: Over $79 billion. …

- Binance Coin (BNB) Market cap: Over $68 billion. …

- U.S. Dollar Coin (USDC) Market cap: Over $53 billion. …

- Solana (SOL) Market cap: $44.5 billion. …

- XRP (XRP) Market cap: $40 billion. …

- Cardano (ADA)

Is crypto money taxed? You’re required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law just like transactions related to any other property. Taxes are due when you sell, trade, or dispose of cryptocurrency in any way and recognize a gain.

Help Foodly.tn team, don’t forget to share this post !