CTC or cost to the company is the amount of money spent by the employer to hire a new employee. It comprises of several components such as HRA, medical insurance, provident fund, etc. which is added to the basic pay. The allowances may include meal coupons, cab service, subsidised loans, etc.

Moreover, What is CTC full form?

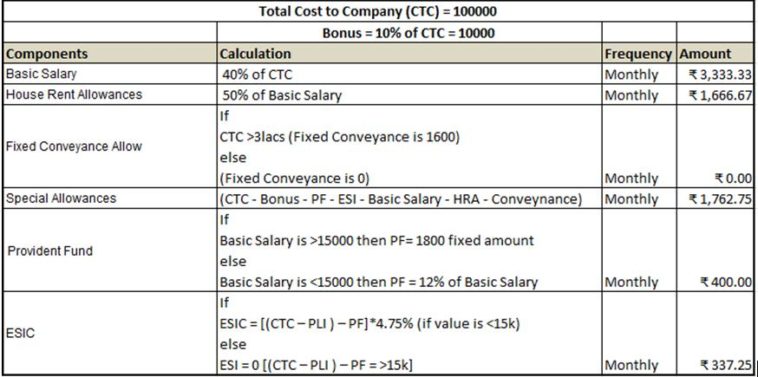

Cost to Company or CTC as it is commonly called, is the cost a company incurs when hiring an employee. CTC involves a number of other elements and is cumulative of House Rent Allowance (HRA), Provident Fund (PF), and Medical Insurance among other allowances which are added to the basic salary.

Secondly, What do you mean by CTC salary 15000?

CTC means Cost To Company. The total cost that a company would incur, on an employee, in a year. Per month salary and other benefits that the company pays an employee, are actually cost to the company. CTC package is a term often used by private sector Indian companies while making an offer of employment.

Beside above What percentage of CTC is in hand salary? It is a part of the Cost to Company (CTC) that the employers pay to the employees for their services. The basic salary is generally around 40% to 50% of your total salary. There is no formula to calculate this amount. It depends on factors like the industry, employee designation, and much more.

In this way, Why all pay is CTC but all CTC is not pay?

In most cases, the bonus is a variable pay component and the final payout may depend not just on your performance but also that of your company’s. So, you may not get the entire amount you were promised in your CTC even if you are a top performer.

What percentage of CTC is PF?

Special allowances-

This is a fully taxable allowance. Provident Fund-A portion of the salary gets deposited in the PF account of the employee. Employer and employee together contribute to the contribution. The contribution to the PF account is 12 per cent of the basic pay.

Contenus

14 Related Questions and Answers Found

What is CTC breakup?

CTC is the abbreviation for Cost to Company and it is the total amount spent by a company on an employee. It is basically the whole salary package of the employee. He may not get all of it as cash in hand, Some amount can be cut in the name of PF and medical insurance, etc. CTC = Gross Salary + PF + Gratuity.

What is CTC and base salary?

The CTC includes all the elements of a salary structure – basic salary, House Rent Allowance (HRA), Basic Allowance, Travel Allowance, Medical, Communication, Provident Fund, Pension Fund, and or any incentives or variable pay.

Is PF part of CTC?

Employer PF is part of CTC not shown on Salary Slip. It is NOT counted as part of your earnings and hence not taxed.

What is CTC in hand salary calculation?

- Usual salary structure components (fixed) of salary of an Employee.

- CTC offered by the employer = INR 9 Lakh per year;

- In hand Salary = CTC – Sum of above components.

- Net taxable income** (Old Tax Regime) = CTC – PF contributions (Both employee & employer contribution) – Food Coupons – HRA tax exemption.

What is current CTC for fresher?

What is current CTC for fresher? It is calculated by adding salary to the cost of all additional benefits an employee receives during the service period. If an employee’s salary is 50,000 INR and the company pays an additional 5,000 INR for their health insurance, the CTC is 55,000 INR.

Is PF mandatory for salary above 15000?

As per the rules, in EPF, employee whose ‘pay’ is more than Rs 15,000 a month at the time of joining, is not eligible and is called non-eligible employee. Employees drawing less than Rs 15,000 per month have to mandatorily become members of the EPF.

What is CTC and gross salary?

Gross salary is the aggregate amount of compensation discharged by an employer or company towards the employment of an employee. The aggregate compensation would be the Cost to Company or CTC to employees. … The employees’ CTC is the gross amount, while the amount of salary one gets to take home is the net salary.

How do I accept a CTC break up?

In coming to this agreement, I believe that we have made a mutually beneficial deal that will be in the best interest of your company. I would like to thank you for giving me the opportunity to fill this position, and am looking forward to fulfilling my new responsibilities with In Your Face Advertising.

What is CTC salary example?

CTC in colloquial terms is the cost an employer bears to hire and sustain its employees. Formula: CTC = Gross Salary + Benefits. If an employee’s salary is ₹40,000 and the company pays an additional ₹5,000 for their health insurance, the CTC is ₹45,000.

Does CTC include TDS?

What is TDS Calculated on? The CTC quoted to you at the time of joining includes components such as basic salary, travel allowance, house rent allowance, medical allowance, dearness allowance, special allowances and other allowances.

What is in hand salary if CTC is 3 lakh?

If 3 lakhs is your fixed salary (varibale component not included), then your approximate monthly income would be somewhere near to 21K. I would say it would be in the ranges of 80 to 85% what is quoted. So 80 to 85% of 25000 is 20000 to 21250per month.

Is 30 lakhs a good salary in India?

Mostly salary is directly proportional to experience. … But after almost 5 to 6 years of experience and with skills a person in India can get 25 lakhs to 30 lakhs per annum. But those people are just about 20% of the population. One platform in India which now gives you better advice is none other than Quora.

Is PF a part of CTC?

Employer PF is part of CTC not shown on Salary Slip. It is NOT counted as part of your earnings and hence not taxed.

What is expected CTC in INR?

CTC is calculated by adding salary and additional benefits that an employee receives such as EPF, gratuity, house allowance, food coupons, medical insurance, travel expense and so on. … If an employee’s salary is ₹40,000 and the company pays an additional ₹5,000 for their health insurance, the CTC is ₹45,000.

Is PF mandatory for salary above 25000?

If your starting salary is above 25000 Rs then it is not mandatory to deduct PF. But if you are already a member of EPF and your monthly salary increases to above 25000 Rs then you have to continue your PF contribution, but PF will be calculated on a limit 0f 15000 salary only.

How is PF salary calculated?

How to calculate EPF? Salary = Basic in private companies. The EPF contribution is usually 12% of the salary. All of this adds up to Rs 4,800, which is deposited monthly as part of the EPF.

How much PF is cut from salary?

You and your employer need to transfer 10% or 12% of your basic salary as contribution towards EPF. In case you are a woman, you only need to contribute 8% of your basic salary for the first 3 years. During this period, your employer’s EPF contribution will remain 12%.

Editors. 19 – Last Updated. 33 days ago – Authors. 2