Direct, indirect, fixed, and variable are the 4 main kinds of cost. In addition to this, you might also want to look into operating costs, opportunity costs, sunk costs, and controllable costs.

Furthermore, What is cost structure example? Examples include sales commissions, product cost, cost of labor and raw materials used in manufacturing, etc. Conversely, fixed costs are those that occur irrespective of the volume of selling or business activities. They are costs that accrue due to the passage of time such as insurance, salaries, and rent.

What are the five cost concepts? Direct/Traceable costs and Indirect/Untraceable costs. Incremental costs and Sunk costs. Private costs and Social costs. Fixed costs and Variable costs.

Besides, What are the 3 types of cost? The types are: 1. Fixed Costs 2. Variable Costs 3. Semi-Variable Costs.

Contenus

What are cost categories?

Cost category means the classification or grouping of similar or related costs for purposes of reporting, determination of cost limitations, and determination of rates.

also, How do you present cost structure? The key elements of the cost structures are as follows:

- Product cost structure. *Fixed costs: *Direct labour and manufacturing overheads. …

- Product line cost structure. *Fixed costs: *Administrative overheads, manufacturing overheads, and direct labour. …

- Customer cost structure. …

- Service cost structure.

How many types of cost structure are there? The four main cost structure types are: value-driven structure, cost-driven structure, economies of scale and economies of scope. The three ways you can analyze your business’ costs are: cost allocation, cost behavior analysis and break-even analysis.

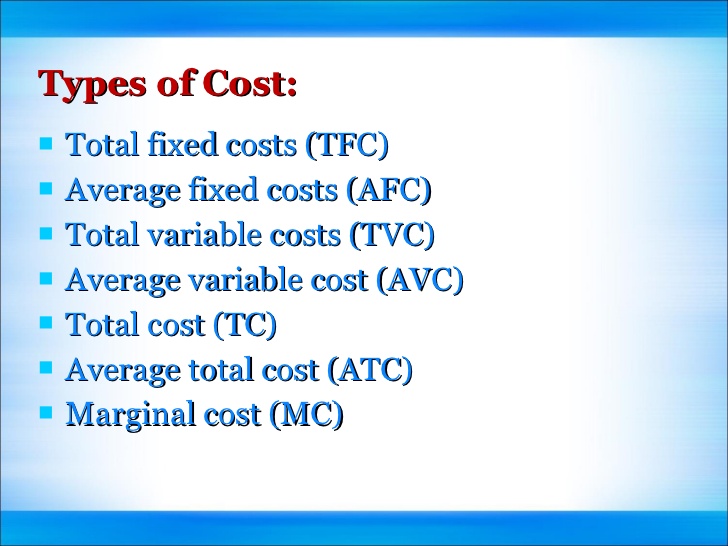

What are the 10 types of cost? Types of Costs

- Opportunity costs.

- Explicit costs.

- Implicit costs.

- Accounting costs.

- Economic costs.

- Business costs.

- Full costs.

- Fixed costs.

What is basic cost concept?

The cost concept demands all assets to be recorded in the books of accounts of the prices at which they were bought. This involves the cost incurred for transportation, installation, and acquisition.

What is cost Class 11? Cost refers to the expenditure incurred by a producer on factor input as well as on new factor input for a given output of a commodity. Total Cost= Explicit Cost + Implicit Cost.

What are the 6 types of cost savings?

The 6 types of cost savings are; historic saving, budget-saving, technical saving, RFB savings, index saving, and ratio saving.

What is basic cost? Basic Cost means the product of (a) Usage multiplied by (b) the Electricity Rate, for the period that corresponds to the period during which Usage was measured.

What are the 4 costs of production?

Types of Costs of Production

- Fixed costs. Fixed costs are expenses that do not change with the amount of output produced. …

- Variable costs. Variable costs are costs that change with the changes in the level of production. …

- Total cost. Total cost encompasses both variable and fixed costs. …

- Average cost. …

- Marginal cost.

How do I activate cost categories?

Alter a single cost category

- Go to Gateway of Tally > Accounts Info. > Cost Categories > Alter (under Single Cost Category ). …

- Select the Cost Category from the List of Categories . The Cost Category Alteration screen appears.

- Make the changes in the required fields.

- Press Ctrl+A to accept.

What is a cost sheet? A cost sheet is a statement that shows the various components of total cost for a product and shows previous data for comparison. You can deduce the ideal selling price of a product based on the cost sheet. A cost sheet document can be prepared either by using historical cost or by referring to estimated costs.

What is the prime cost? A prime cost is the total direct costs of production, including raw materials and labor. Indirect costs, such as utilities, manager salaries, and delivery costs, are not included in prime costs. Businesses need to calculate the prime cost of each product manufactured to ensure they are generating a profit.

More from Foodly tips!

How can cost structure be improved?

Manage your company’s expenses with several verified strategies.

- Define your fixed and variable expenses. …

- Enter your budget into accounting software. …

- Create a cost management strategy. …

- Reduce variable costs. …

- Reduce fixed expenses. …

- Reduce your break-even point and become profitable sooner.

What is fixed cost example? Examples of fixed costs are rent and lease costs, salaries, utility bills, insurance, and loan repayments.

What is a value driven cost structure?

Value-driven structures are focused on providing more value or revenue through premium offerings or services. Companies that embrace a value-driven structure use customer intimacy and high-end components to create premium products.

What is the purpose of cost structure? Usage and Importance

The idea of identifying the cost structure is to allocate costs between fixed and variable costs effectively. These costs are then associated with individual products and product lines to ascertain their correct pricing.

Help Foodly.tn team, don’t forget to share this post !